Private Educational Loans

Private student loans are offered through a variety of banks and other lenders. Students wanting private loans must apply separately from their financial aid application through an individual lender. The best rates on these loans are generally offered to borrowers with good credit and/or who have a cosigner with good credit.

When shopping for a private loan, look for a loan you can live with in both the short term and the long term. You may be repaying it for multiple years after graduation. Many loan providers will lend up to the amount of the student’s cost of attendance minus any financial aid received. Often there is a yearly and/or cumulative cap on the amount the student may borrow; sometimes this cap is set by the student’s school. Note that it takes two to four weeks to process private loans through our office.

Most lenders require half-time student enrollment. Our staff checks enrollment status when a loan is disbursed, not when the loan is certified. Many private education lenders also require student borrowers to have a loan cosigner.

In addition to increasing your chances of getting your loan approved, having a cosigner sometimes helps you get a lower interest rate and may reduce the approval time. Your cosigner need not be a relative, but should be someone with a steady income and a good credit history. Some lenders will release the cosigner from the loan if the student borrower has met certain requirements, such as making payments on time.

Under provisions of the Truth in Lending Act, private education loan lenders (including long-term U-loans and Health Professions Loans) must:

Your lender should provide you with these requirements. If you have questions, contact our office.

You must submit a completed Private Education Loan Applicant Self-Certification form to your lender. Your loan will not disburse until your lender receives it.

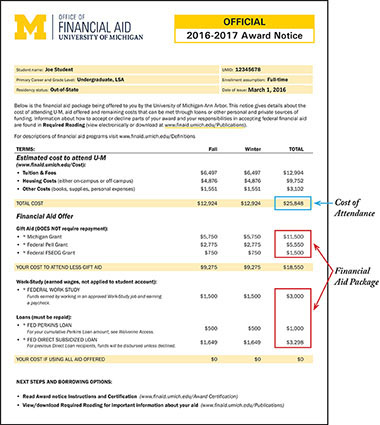

Cost of Attendance is at the top of your financial aid notice and your total financial aid offer in the sections at the bottom. To get the total figure, you must tally the aid awarded in each section including Gift Aid, Work-Study, Loans, and Other.

If you are not receiving financial aid, find your cost of attendance using figures on the Cost of Attendance page.

If you are considering borrowing through a private lender, we encourage you to:

If you pursue a private loan, apply directly through the lender you select. Choose any lender and the university will certify your application.

U-M students should avoid lenders that don't require U-M to certify their loan application and should be suspicious of unsolicited loan offers. The Michigan Student Financial Aid Association cautions students that "loan debt can accumulate quickly and result in a lifetime burden of high payments and credit denials for automobile purchases, credit cards, and home mortgages. Private loans also can reduce eligibility for more desirable federal, state, and college aid programs. To avoid these problems, read and understand the terms and conditions of all loans."

To browse a selection of lenders, please visit the University of Michigan's FastChoice Private Education Loans website. If you are an international student, visit the University of Michigan's FastChoice International Private Education Loans website. Students are welcome to use any lender of their choice.

The university adheres to a Code of Conduct for Student Loans that prohibits inducements or incentives by private lenders.

| Interest Rate | APR | Monthly Payment |

|---|---|---|

| Prime +0.00% | 7.98% | $64.48 |

| Prime -0.50% | 7.51% | $61.35 |

Note: This APR example is based on borrowing a $6,000 undergraduate loan with a 38-month deferral period followed by a 240-month repayment period. The Prime Rate is assumed to be constant at 8.25%. Interest rates indexed to the Prime Rate as published in The Wall Street Journal will vary. The APR will increase if the Prime Rate increases and would result in a higher monthly payments, an increase in the number of scheduled payments, or both.

| Interest Rate | APR | Monthly Payment |

|---|---|---|

| Prime +0.00% | 8.10% | $80.82 |

| Prime -0.50% | 7.62% | $77.13 |

Note: This APR example is based on borrowing an $8,000 graduate loan with a 27-month deferral period followed by a 240-month repayment period. The Prime Rate is assumed to be constant at 8.25%. Interest rates indexed to the Prime Rate as published in The Wall Street Journal will vary. The APR will increase if the Prime Rate increases and would result in a higher monthly payments, an increase in the number of scheduled payments, or both.