Dental Required Reading

Your reference and resource guide to financial aid for D.D.S. students at the University of Michigan-Ann Arbor.

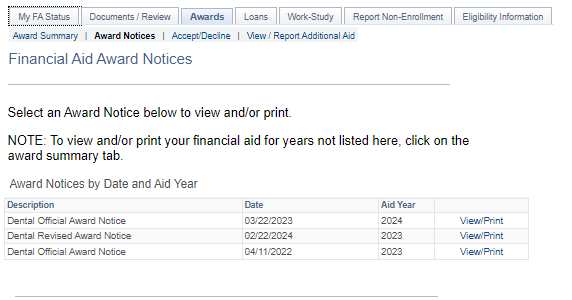

To download your Official Financial Aid Notice Letter:

Log in to Wolverine Access > select Student Business > Student Center > Financial Aid > Aid Year > Awards > Award Notice. Click on View/Print to review and download the Financial Aid Award Notice.

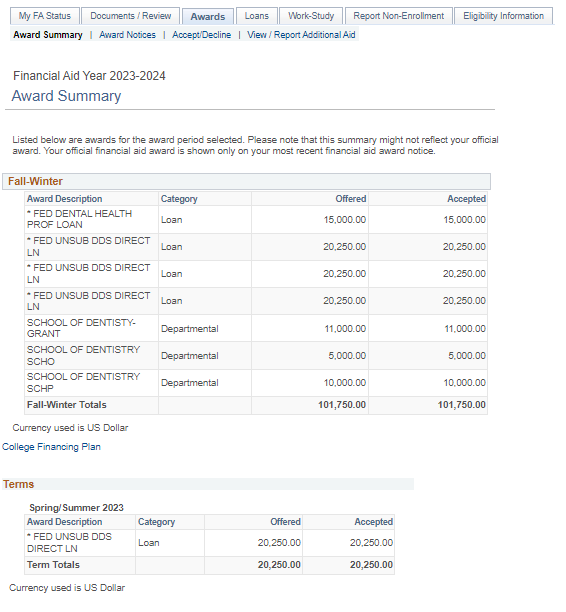

To view just a summary of your Awards:

Log in to Wolverine Access and select Student Business > Student Center > Financial Aid > Aid Year > Awards > Award Summary.

Read your Financial Aid Notice and refer to this site for information about the financial aid you have been offered.

Review Aid Award Notice to ensure personal information is correct. If name, UMID number, residency status, grade level, or career are incorrect, contact the Office of the Registrar. If your address is incorrect, update this using Wolverine Access.

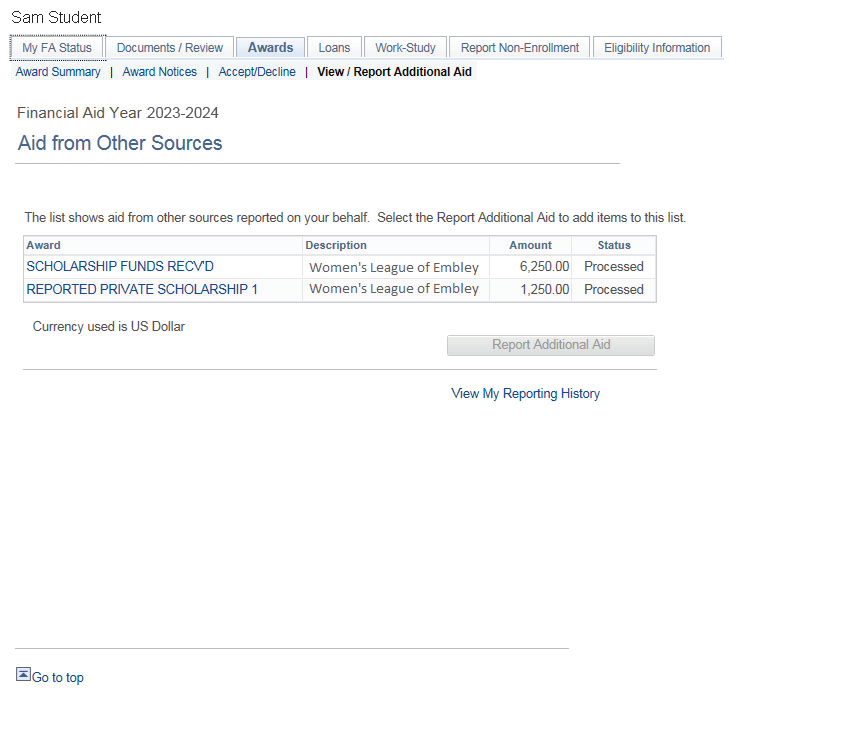

Report any additional aid awards you may receive (i.e., private scholarships, Michigan Education Trust, veteran benefits, etc.) not listed on your Financial Aid Award Notice. You may report these through Wolverine Access under the View/Report Additional Aid from the Awards tab.

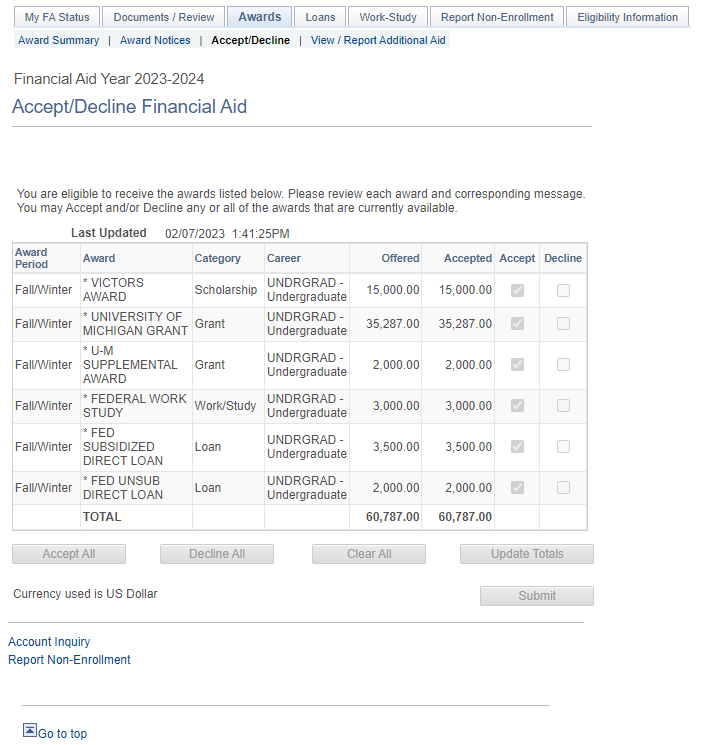

We assume you are accepting all offered aid, including your offer of loan(s) assistance. If you do not wish to accept your loan (or any other offer of aid) or wish to reduce the amount, you must communicate this by logging in to Wolverine Access, selecting Accept/Decline from the Awards tab (not functional in Prospective Student Business) or you may email [email protected].

Note: If you are a first-time federal loan borrower you will be required to sign a Master Promissory Note and complete Entrance Counseling on the Federal Student Aid website to fully accept your direct loan offers.

Set up Direct Deposit through Wolverine Access, through the Student Business > Payroll and Compensation tab.

Finally, if you want a parent/guardian to have access to your financial aid information, authorize a Friend Account.

Check your email and the Documents/Review page of the Wolverine Access Financial Aid section. Respond immediately to requests from our office for additional information.

If aid is adjusted, you will get an email noting that you have a revised Award Notice.

Complete/sign all applicable promissory notes; look for an email from our office:

Direct Loans: If you have Direct Loans, complete your Direct Loan Master Promissory Note (MPN) online on the Federal Student Aid website to receive your funds. See our MPN webpage for more information. (If you have previously signed a Direct Loan MPN at U-M, do not sign another unless you have been out of school for a year or more.) First-time borrowers at U-M must also complete loan entrance counseling. Complete the counseling online at the Federal Student Aid website. You will receive an email reminder during the summer.

Health Profession Loans: If you have been awarded a Health Professions loan, complete your loan documents (MPN, Rights and Responsibilities Statement) online using Wolverine Access to receive your funds. See our Health Professions & Nursing loans page for more information. (If you previously signed a Health Professions loan MPN at U-M, you do not need to sign another.) Health Professions loan recipients must complete a Rights and Responsibilities Statement each year on Wolverine Access.

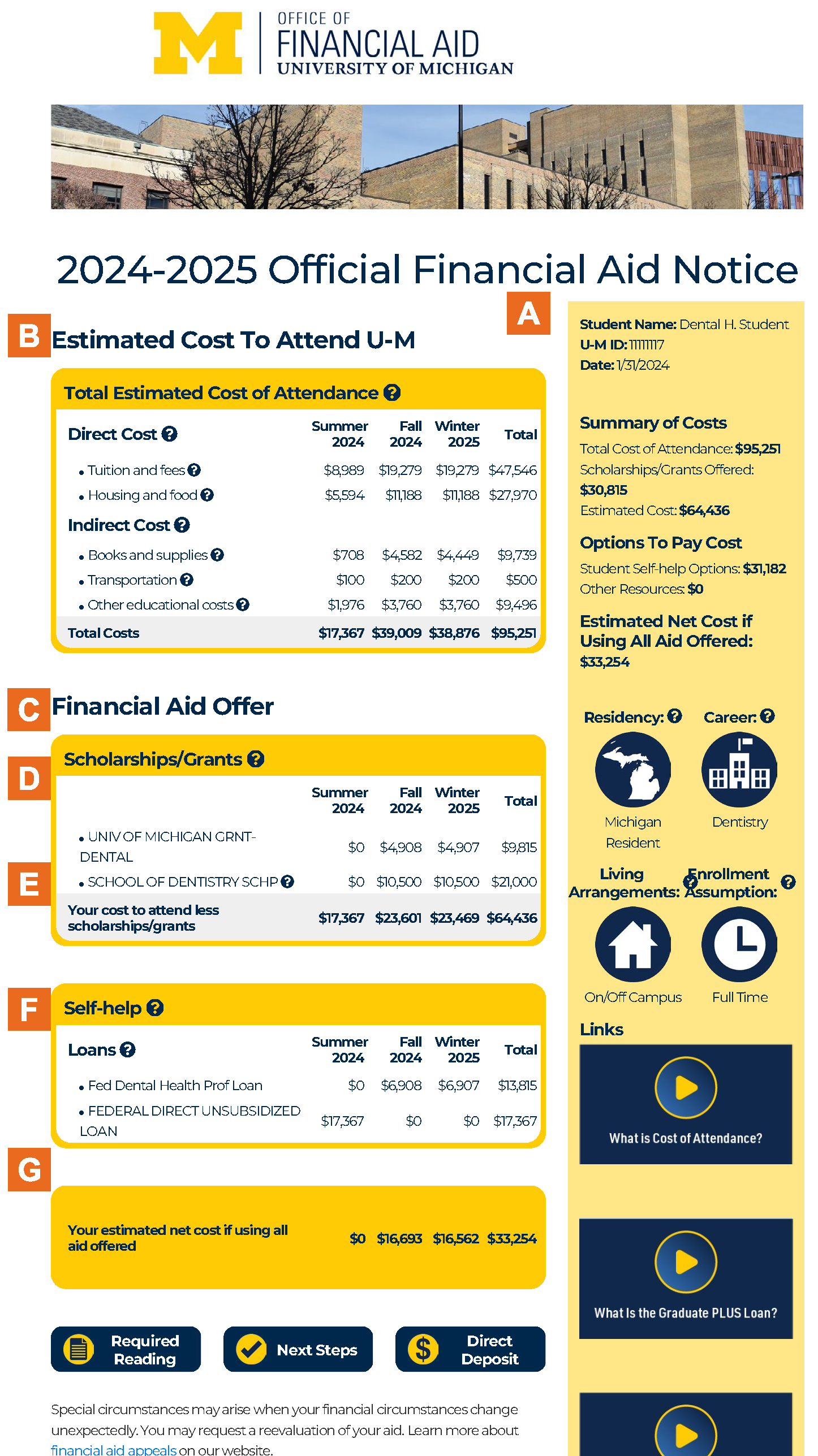

This is a description of your U-M Financial Aid Notice. Read all parts of your agreement to accept federal aid funds. The Next Steps link on your Financial Aid Notice has instructions about what to do next and details the cost of borrowing and consumer information about the university. Information from your financial aid application such as income, assets, family size, as well as residency status, program, and enrollment determines your eligibility for aid and what type of financial aid you will receive.

Your Financial Aid Notice includes:

This section shows a summary of your information Including:

Residency

Residency at time of admission determines your tuition rate. Contact the Office of the Registrar at 734-764-1400 or visit their website.

Career

Your school or college (also called your career) based on information from the Office of the Registrar. Email [email protected] with questions.

Living Arrangements

Your living arrangements impact your costs. Living at home with family will be less costly than living on campus in a residence hall and paying for housing and food costs to your student bill or living off campus and paying for your rent and other living expenses privately. If the assumption on your notice is incorrect, please notify the Office of Financial Aid immediately by submitting a Change to Living Arrangements request.

Enrollment Assumption

Your anticipated enrollment is based on the School of Dentistry full-time enrollment requirements. If your planned enrollment is different from what's listed on the Financial Aid Notice, promptly email [email protected].

This section shows the estimated amount it costs to attend U-M for the period covered by your Financial Aid Notice.

Tuition and Fees

As charged on your student bill

Housing and Food

Your actual housing cost may be higher or lower, depending on your lifestyle. The Cost of Attendance budget allows the same amount for housing and meals whether you are on or off campus.

Indirect Costs

Can include books, supplies, transportation, and personal expenses. Your actual expenses may vary; periodic student surveys determine these personal costs and estimates of typical aid. (See “What Are My Costs” section.)

C. Financial Aid Offer

This section lists your financial aid for each term.

D. Scholarships/Grants

If you receive scholarships or grants (known as gift aid, or money that is not repaid), they will fall under this section.

E. Your Cost To Attend Less Scholarships/Grants

We subtract your gift aid from your total Cost of Attendance and display the amount remaining to be covered. The remaining sections in the Financial Aid Notice offer you self-help for paying this amount and can include:

F. Loans

These are funds that students borrow from the federal government or other lenders. Loans must be repaid when students graduate or stop attending school. Students who apply for loans will be offered the maximum eligibility, unless otherwise indicated. Borrow only what you need. If you wish to reduce the offered loan amount, please contact financial aid at [email protected].

G. Estimated Net Cost

This shows your estimated net cost if using all aid offered.

Financial aid programs were created with the assumption that the primary responsibility for paying for college rests on the student and family. Need-based financial aid is available to students demonstrating a need for additional resources. Financial aid for D.D.S. students is awarded based on three factors:

To determine your federal financial aid eligibility, we use information reported on your FAFSA, plus other documents you submit, to calculate the Student Aid Index (SAI). The SAI is an eligibility index number that the Office of Financial Aid uses to determine how much federal student aid a student may be able to receive while attending school. The SAI analysis is a federal formula that takes into account the income and assets of a student, their parents, and/or spouse, if applicable.

The SAI number is not a dollar amount of aid eligibility or what is expected for the family to provide.

Most D.D.S. students are eligible for a Federal Direct Unsubsidized Loan. (This is a non-need-based loan.) Parental data is not required for the Federal Direct Unsubsidized loan. Some may also be eligible for a Federal Health Professions Student Loan and/or School of Dentistry Grant. By federal law and university policy, the Federal Health Professions Student Loan and School of Dentistry Grant must be awarded to the students with the most demonstrated need. These funds are limited. Students with the fewest family resources may receive the Federal Health Professions Student Loan and/or the School of Dentistry Grant.

A lower or negative SAI indicates greater financial need.

Students who need additional funds or who are not eligible for need-based aid may consider supplemental loans such as the Federal Direct Grad PLUS loan or private loans.

Visit the Doctor of Dental Surgery webpage for the latest cost of attendance figures.

Your Financial Aid Notice has your estimated Cost of Attendance used to calculate your financial aid offer. Use the Cost of Attendance worksheet to calculate your personal budget and the amount you will need to contribute or borrow for your education.

Use your budget from the top section of the worksheet and the award amounts from your aid offer to complete lower section of worksheet. This will help you see what you will need to pay or borrow to cover your college costs. Charges/costs and aid can change each semester. Please see your Financial Aid Notice for term-by-term changes in aid.

If you live off campus, you could save money by having roommates. The four Cs that can bust your budget: cars, clothes, credit cards, and cell phones.

To see an estimate of what your university bill will look like or to find out how much private or Grad PLUS loans you are eligible to borrow, select Financial Planning Calculators while in Wolverine Access.

Learn more about scholarships, grants, and loans for D.D.S. students.

See examples for what monthly payments for a loan may be depending on different interest rates.

If you are borrowing federal Direct loans you can view how much you have borrowed to date from each program by going to the Federal Student Aid website. Cumulative borrowing for Health Professions and Nursing loans can be found on Wolverine Access. For a simple loan repayment calculator, visit the Federal Student Aid website.

When you utilize our offer of financial aid, you agree to review the Award Certification information and fulfill the following responsibilities, including the terms and conditions and enrollment requirements set by the federal regulations for financial aid.

Don't forget to review Consumer Information.

Learn more about receiving your aid, refunds, handling checks, and more on the Aid Payments & Your Bill webpage.

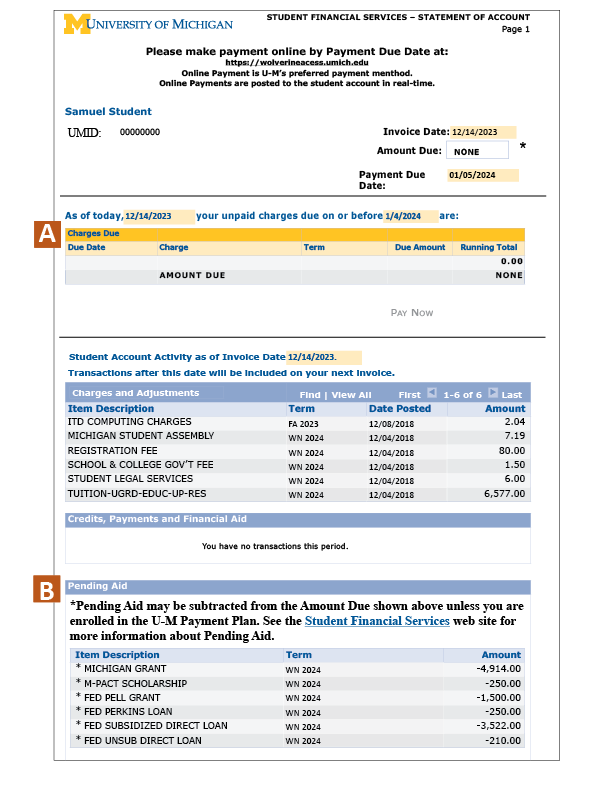

Your university student billing account is maintained by Student Financial Services/Teller Services (Cashier’s Office), which notifies students by email mid-month when there is an eBill available to view/print on Wolverine Access.

Payment for each term’s charges is due on the date specified in the eBill. Financial aid (including private scholarships and Michigan Education Trust contracts) is applied directly to the charges, usually during the first month of the term.

Some types of aid have restrictions. For example, federal aid cannot be used to pay for orientation charges and lost ID card fees. Some university awards/scholarships can only pay for tuition/fees and/or housing/meals, so you could receive a refund even with outstanding charges. You are responsible for paying those charges using your refund or other sources.

To view your charges in detail, select Account Inquiry from your Student Center. The Charges Due page [A] that opens shows a “running total” of your charges due by due date. You may view individual bills by clicking on the invoice number in the Invoices Due section.

The Invoice Detail page shows the details of your monthly bill. The activity and amount due are current as of the date you review the bill and will change as payments and credits are posted to your account. If you have questions about the bill, click the Help button on the page and go to Student Business Help.

Note: All U-M grant funds are applied first to tuition charges and then to other on-campus charges.

Because initial student bills for a term are issued before financial aid, a special section – Pending Aid [B] – is included showing any financial aid funds that the university expects to credit to your account, based on your aid award. If you are enrolled full-time and you have signed the required documents (such as loan documents), pending aid will appear on your bill.

Disbursement of financial aid funds to students’ accounts begins shortly before the start of the term. When funds are credited to your account, pending aid is removed.

Some sources of financial aid – such as graduate student instructor/research assistant tuition waivers, private and PLUS loans, and third-party credits and private scholarships for which funds have not yet been received – will not appear on your bill as pending aid. They will be shown on your student account after we receive the funds.

If funds you are expecting have not appeared on your account by the time you pay your bill, pay the amount due to avoid receiving a late fee. Once funds are credited to your account, you will see a credit on your monthly bill.

Expenses such as books (which are included in your estimated cost of attendance) do NOT appear on your eBill.

Federal Direct Loan (Unsubsidized and PLUS) payments applied to your account will be lower than the amounts awarded because the origination fees are deducted.

Late payment fee for an unpaid balance on your student account is $30 per month.

Students sometimes find it necessary to withdraw from all classes during a semester. Depending on when this occurs, students may receive a refund of all or part of tuition and fees. If the student is a financial aid recipient, the university and student may be required to return the aid, or a portion of it, to the federal government.

The university has a tuition refund policy stipulating the amount of tuition and fees refunded to a student who withdraws from all classes during a term. The Registrar’s Office determines specific refund dates each term, see “Student Registration Deadlines.” The chart below shows the amount of tuition and fees returned based on when the student withdraws. Students must notify the Registrar’s Office immediately by following specific withdrawal procedures. Visit the Registrar’s Office website.

Withdrawal* | % of Charges Refunded |

Before the first day of the term | 100% tuition; 100% fees |

Within the first three weeks of the term | 100% tuition; 0% fees |

After the first three weeks but before the sixth week of the term | 50% tuition; 0% fees |

After the sixth week of the term | 0% tuition; 0% fees |

If a student receives a failing grade, does not attend, or stops attending class, the federal government considers this an unofficial withdrawal. In these cases, students can be required to repay aid received. If you have questions about enrollment and aid eligibility, contact the Office of Financial Aid for assistance.

Funds returned to the federal government reimburse the individual federal programs from which the student received the aid. Financial aid returned (by the university and/or the student or parent) must be allocated, in the following order, up to the net amount disbursed from each source:

Learn more about the process for the Return of Federal (Title IV) Financial Aid.

We recognize that some students and families experience special circumstances that affect their ability to pay for college. Contact us immediately when family financial circumstances change and provide documentation so we can review your situation. Assistance will depend upon whether funds are available at that time. If your Cost of Attendance is adjusted, you may be eligible to borrow more in loans.

Circumstances considered include:

Note: Evaluation of financial aid applications, reevaluation of an aid package, or an appeal of a financial aid decision are handled through a review process using professional judgment by financial aid professionals in the U-M Office of Financial Aid. Any request to our office is considered using best professional practices and making such a request does not guarantee approval. Financial aid regulations are subject to change through legislation or policy changes by the U.S. Department of Education.

All requests for aid reevaluation must be received a minimum of three weeks prior to the end of the enrollment period. The U-M Office of Financial Aid cannot guarantee that requests received after this point will be funded. We cannot, under any circumstances, process a request received after the end of the enrollment period. If you have questions regarding this policy, please contact our office.

If you have a question or concern regarding a financial aid policy or decision, or you wish to appeal it, follow the procedure detailed here.

Step 1

Present your situation to D.D.S. Financial Aid. All options should be explored at this level before moving to the next step. If the situation cannot be resolved here, Dr. Reneé Duff will determine whether the appeal should go to Step 2a or 2b.

Step 2

a. D.D.S. Financial Aid presents your situation to the Special Circumstances Review Committee in the Office of Financial Aid. This occurs if unusual circumstances require exceptions to standard financial aid policies or procedures. If you have additional information regarding your situation, please include it with your appeal.

b. Complete an appeal form and schedule an appointment to discuss the appeal with an associate financial aid director.

Step 3

If you believe your situation warrants further consideration after completing step 2, you may request a review with the Office of Financial Aid executive director.

Call or write to D.D.S. Financial Aid beginning in May of the new academic year to request a copy of the special circumstances reevaluation application and instructions. Deadline to submit the reevaluation application is by April 1 before the end of the academic year.

Continuing students must reapply for financial aid each year by completing a new Free Application for Federal Student Aid (FAFSA), and each winter term you will receive an email reminder from us. You are likely to receive similar financial aid packages throughout your time at U-M if the following conditions remain constant:

Continuing students should begin planning for next year in the fall of the current academic year.

Early winter semester, the Office of Financial Aid will notify students by email to apply for the next academic year.

December-March

To apply for federal aid for the next academic year (spring/summer, fall, and winter):

February/March

Apply for an additional Grad PLUS or private loan for spring/summer term:

March-July

June/July

If you received aid from other sources, such as departmental awards or private scholarships, educate yourself about the application requirements and deadlines for those programs. To find out about reapplying for these programs, contact the organization that awarded the funds to you.

I would like to purchase a computer or a pair of loupes. Can I get money from the Office of Financial Aid to cover this?

The Office of Financial Aid allows students to borrow for the purchase of a computer and a pair of loupes. This can be done only once during an educational career, per item, at the university. Documentation (receipt or written estimate) of the purchase is required. Contact [email protected].

Do I have to report any grants, scholarships, or fellowships to the Internal Revenue Service (IRS) as income?

Part or all of a grant, scholarship, or fellowship may be taxable, even if you do not receive a W-2 form. If you are in a degree program, amounts you use for expenses other than tuition and course-related expenses (i.e., amounts used for room, board, and travel) are taxable. To determine this taxable amount, add up all grant, scholarship, and fellowship awards received in a calendar year then subtract all tuition, fees, and book and supply expenses. If the remaining amount is a positive number, it must be reported as income. This amount must also be reported on your FAFSA. Contact the IRS for more detailed information.

Am I allowed to receive financial aid from more than one institution at the same time?

No. If you are enrolled at more than one college or university at the same time, you may receive financial aid from one of the institutions, not both. Contact D.D.S. Financial Aid at [email protected] for more information.

How can I learn more about the federal education credits?

The American Opportunity Tax Credit helps pay expenses for the first four years of post-secondary education. The Lifetime Learning Credit of up to $2,000 is based on qualified tuition and related expenses you pay for yourself, your spouse, or a dependent claimed on your tax return. You cannot claim both in the same year. Credits are claimed using Form 8863, attached to Form 1040 (available on the IRS website). Form 1098-T is available on Wolverine Access. These credits must also be reported on your FAFSA.

Office Of Financial Aid, School of Dentistry

G226 Dental Bldg.

1011 N. University Ave.

Phone: 734-647-8592

Fax: 734-764-1922

Email: [email protected]

Student Financial Services/Teller Services (Cashier’s Office)

2226 Student Activities Bldg.

515 E. Jefferson St.

Phone: 734-764-7447

Toll free: 1-877-840-4738 (in U.S. & Canada only)

Housing Information Office

1011 Student Activities Bldg.

515 E. Jefferson St.

Phone: 734-763-3164

Central Campus - Wolverine Services

2200 Student Activities Bldg.

515 E. Jefferson St.

Phone: 734-647-3507

Residency Office

LSA Suite 5000

500 S. State St.

Phone: 734-764-1400

Email: [email protected]

School of Dentistry Registrar’s Office

G226 1011 N. University Ave.

Ann Arbor, MI 48109-1078

Phone: 734-764-1512

U.S. Department Of Education Federal Student Aid

1-800-433-3243

List of loan servicers

Online master promissory note, entrance counseling, exit counseling, loan consolidation, PLUS loan application

MI Student Aid (State of Michigan)

P.O. Box 30462

Lansing, MI 48909-7962

1-888-447-26 87 (4-GRANTS)

Email: dentistry.registrar@umich. edu

Payroll Office (Direct Deposit)

G395 Wolverine Tower-Low Rise

3003 S. State St.

Phone: 734-615-2000

Toll free: 1-866-647-7657 (option 2)

Student Loan Collections

6000 Wolverine Tower

3003 S. State St.

Ann Arbor, MI 48109-1287

Phone: 734-764-9281

Toll free: 1-800-456-0706 (in U.S. only)

With this password-protected site you can access your financial aid and eBill information, decline/reduce your aid, and complete Health Professions Promissory Notes. You can authorize a Friend account for your parents or family so that they may also view/print your Award Notice and eBills from Wolverine Access.

Free Scholarship Search Services

Refer to our website for information on private scholarships and online search services.

The Office of Financial Aid staff sometimes requests student and family financial information as part of our application review process. Requested documentation can be directly uploaded into your U-M Student Forms Portal through Wolverine Access, via fax, or in person at our office. Do not email documents. Please take care that your full Social Security number is not transmitted for your safety and security. Show ONLY the last four digits when submitting tax returns or other required documents. Cross out and conceal other portions of this identifier. When contacting us, always include your UMID. Use of professional judgment: Evaluation of financial aid applications, reevaluation of an aid package, or an appeal of a financial aid decision, are handled through a review process using professional judgment by financial aid professionals in the U-M Office of Financial Aid. Any request to our office is considered using best professional practices and making such a request does not guarantee approval. Financial aid regulations are subject to change through legislation or policy changes by the U.S. Department of Education.