Fall/Winter Required Reading

Your reference and resource guide to financial aid at the University of Michigan-Ann Arbor.

The U-M Office of Financial Aid will email you when your Financial Aid Notice is available to view. The email subject line will say "You Have a Financial Aid Offer to View." The quickest way to access your aid offer is to use the direct link in that email message. The most current aid offer information will always be posted online in Wolverine Access in your Financial Aid Award Summary.

Your student portal in Wolverine Access is an important resource to conduct university business. Learn more by visiting Using Wolverine Access.

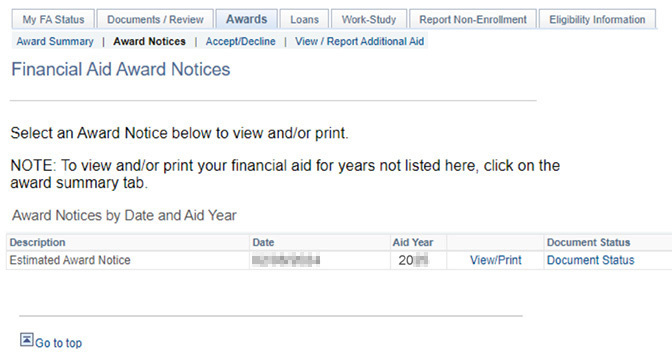

To view/print your Financial Aid Notice:

We recommend that you save or print a copy of your Financial Aid Notice for your files. It is only available for a limited time to download.

Learn about the terms and conditions of your aid.

Read your Financial Aid Notice and refer to information in Required Reading about the financial aid you have been offered.

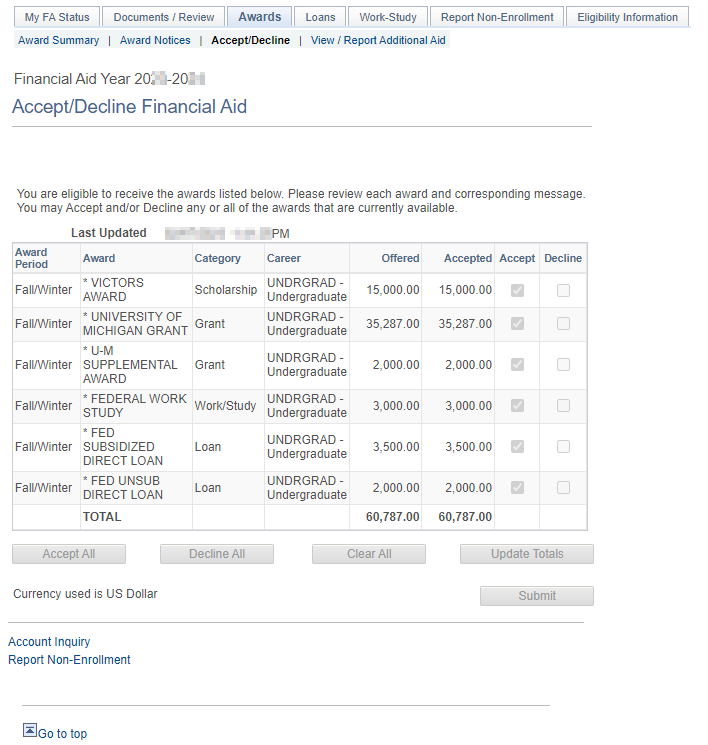

IMPORTANT: We assume you are accepting all offered aid, including your offer of loan(s) assistance. If you do not wish to accept your loan (or any other offer of aid) or wish to reduce the amount, you must communicate this by logging in to Wolverine Access, selecting Accept/Decline from the Awards tab (only available when you have a uniqname and are logging in through Student Business).

Note: If you do not sign your loan promissory note and complete entrance counseling, you will not receive your loan funds. Learn more about your Federal Direct Loans.

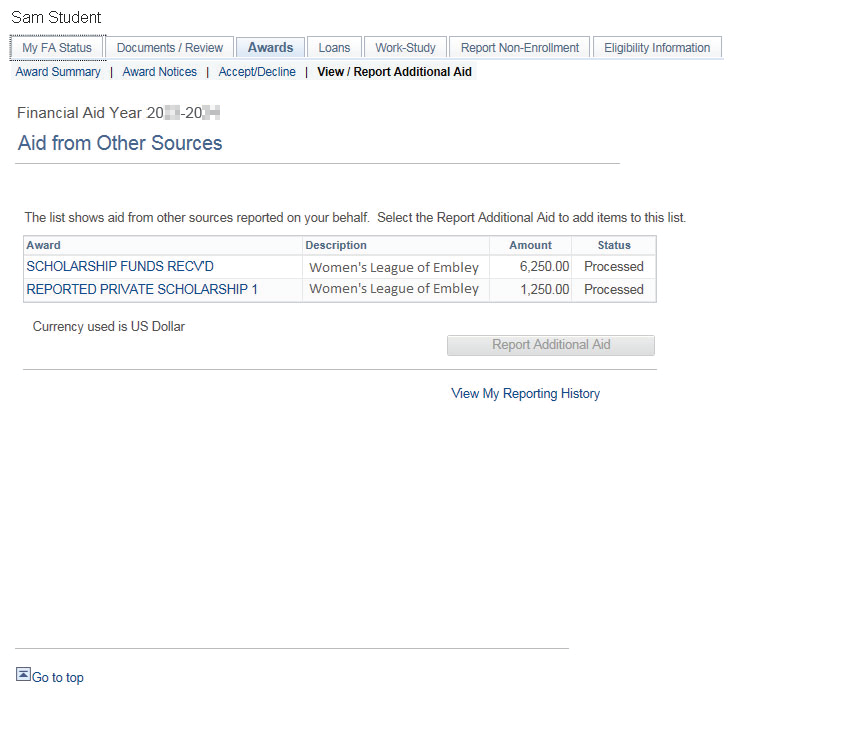

Notify us if you receive scholarships, department funding, fellowships, or other aid not listed on your Financial Aid Notice. Select View/Report Additional Aid from the Awards tab to do this.

If your name, U-M ID, residency, and/or career are not correct on your Financial Aid Notice, contact the Registrar’s Office as soon as possible. If your address is incorrect, change it using Wolverine Access.

Complete your online Federal Direct Loan Master Promissory Note and Entrance Loan Counseling and review important information about your federal loan accounts online on the Student Aid website.

Finally, if you want a parent/guardian to have access to your financial aid information, authorize a Friend Account.

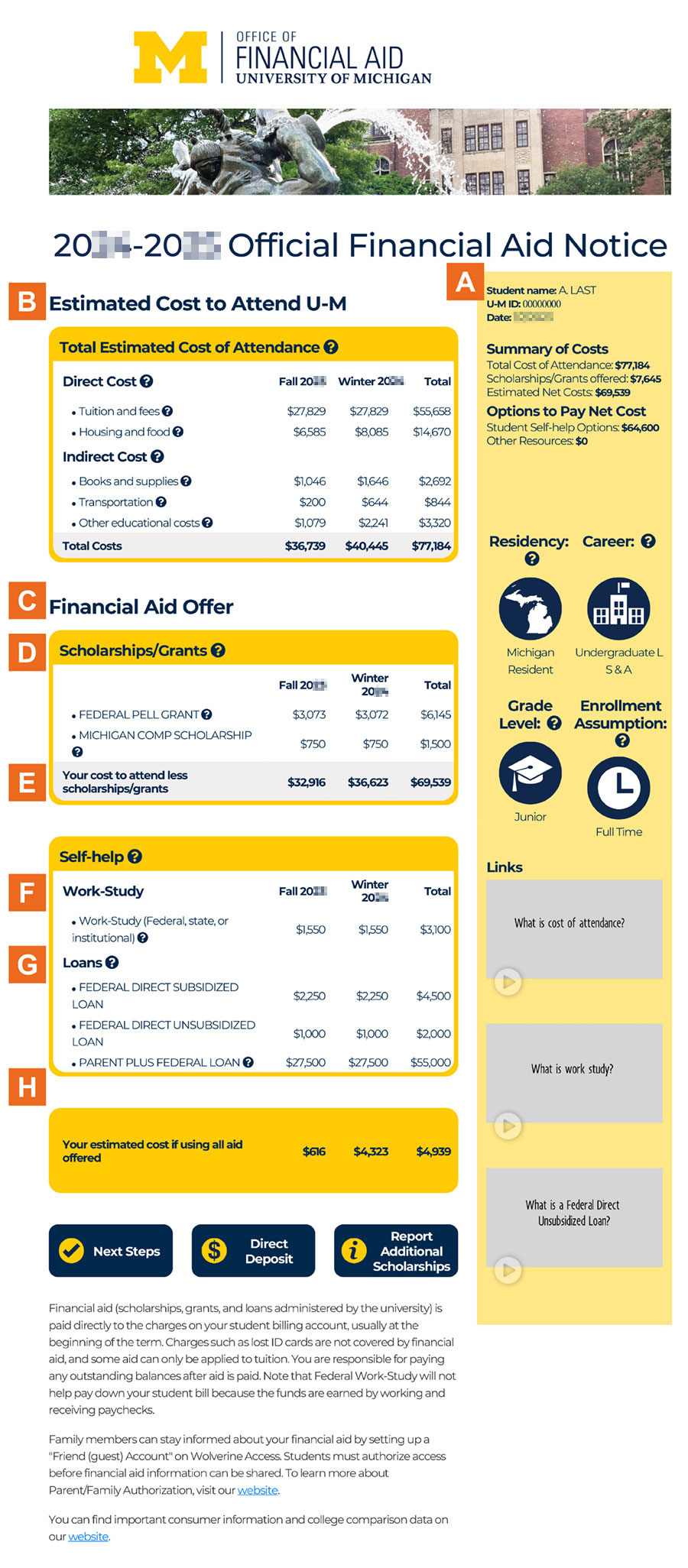

This is a description of your U-M Financial Aid Notice. Read all parts of your agreement to accept federal aid funds. The Next Steps link on your Financial Aid Notice has instructions about what to do next and details the cost of borrowing and consumer information about the university. Information from your financial aid application such as income, assets, family size, as well as residency status, program, and enrollment determines your eligibility for aid and what type of financial aid you will receive. Your Financial Aid Notice includes:

This section shows a summary of your information Including:

Residency

Residency at time of admission determines your tuition rate. Contact the Office of the Registrar at 734-764-1400 or visit their website.

Career

Your school or college (also called your career) based on information from the Office of the Registrar. Contact them with questions.

Living Arrangements

Your living arrangements impact your costs. Living at home with family will be less costly than living on campus in a residence hall and paying for housing and food costs to your student bill or living off campus and paying for your rent and other living expenses privately. If the assumption on your notice is incorrect, please notify the Office of Financial Aid immediately by submitting a Change to Living Arrangements request. A change to living on or off campus does not need to be reported and will not change our estimate of your expenses, but please let us know if you are moving in with your parents or moving out of living with your parents.

Enrollment Assumption

We assume full-time enrollment for aid purposes; students must be enrolled at least half-time to receive aid. Grant or scholarship aid may be reduced if your actual level of enrollment is less than full-time. We will monitor enrollment, and changes may reduce or cancel aid, even after you receive your funds.

This section shows the estimated amount it costs to attend U-M for the period covered by your Financial Aid Notice.

Tuition and Fees

As charged on your student bill

Housing and Food

On or off campus. This is an estimate of the average costs of living expenses. Students are expected to budget for a modest lifestyle. Housing and food costs will only be directly billed to your University of Michigan student account if you live in university housing. If you live off-campus and have a lease with a private landlord, you will not be billed by the university but by your landlord directly.

Indirect Costs

Can include books, supplies, transportation, and personal expenses. Your actual expenses may vary; periodic student surveys determine these personal costs and estimates of typical aid. (See “What Are My Costs” section.)

C. Financial Aid Offer

This section lists your financial aid for each term.

D. Scholarships/Grants

If you receive scholarships or grants (known as gift aid, or money that is not repaid), they will fall under this section.

E. Your Cost To Attend Less Scholarships/Grants

We subtract your gift aid from your total Cost of Attendance and display the amount remaining to be covered. The remaining sections in the Financial Aid Notice offer you self-help for paying this amount and can include:

F. Federal Work-Study

This federal program allows you to apply for Federal Work-Study jobs and earn a paycheck to help you pay for college.

Federal Work-Study will not help pay down your student bill because the funds are earned by working and receiving paychecks. Students who use Federal Work-Study are committing to working while attending school to supplement other financial aid for out-of-pocket miscellaneous educational expenses.

G. Loans

These are funds that students borrow from the federal government or other lenders. Loans must be repaid when students graduate or stop attending school. Federal loan and institutional loan repayment begins six months after you graduate, withdraw, or drop below half-time status. Borrow only what you need.

H. Other Resources

These include some VA benefits, third-party credits, or prepaid tuition plans, among others.

Note: These will only appear on your financial aid notice if you are receiving other resources and they will help you with your educational costs.

See more on our How Aid Is Awarded webpage.

Students may receive scholarships from U-M schools and colleges or private sources or have housing benefits.

These are considered financial resources when determining need-based aid eligibility and improve your overall aid package.

Here is how additional aid works:

1. Additional aid is first applied against any gaps between your calculated need (i.e., the cost of attendance minus the federally calculated Student Aid Index (SAI)) and the other aid that you were offered. Outside aid can fill in those gaps, but it will not reduce or replace the federally calculated SAI. The SAI indicates the least amount a student and family should be able to contribute towards costs as determined by Federal Student Aid.

2. If your additional aid exceeds any gap in costs after your family contribution and other aid are considered, it next reduces your self-help aid like loans or Federal Work-Study.

3. Your grant aid will only be reduced if gaps in your need are filled and if all need-based loan and Federal Work-Study are replaced by scholarships or other resources.

Some important exceptions:

Some Office of Financial Aid scholarships are awarded based on student need. This may reduce your University of Michigan Grant, but your total aid should remain the same or be higher.

Your tuition and fees can only be covered up to 100%. Receiving a full-tuition scholarship such as Detroit Promise reduces your eligibility for other tuition awards such as the Go Blue Grant.

Please note: Most scholarships require full-time enrollment before disbursement.

Your Financial Aid Notice has your estimated cost of attendance, which is used to calculate your financial aid offer. Your actual costs will vary depending on your living expenses and lifestyle choices. The estimated cost of attendance is based on average expenses incurred by typical students to maintain a modest student lifestyle.

You can calculate your personal net cost by subtracting the financial aid (gift aid and self-help) that you will use from your budgeted expenses. It will help you estimate how much you and your family will need to contribute after all financial aid is applied.

Visit Wolverine Access to estimate your bill, loan eligibility, or amount for U-M payment plan.

To estimate your university bill; determine private educational loan, PLUS loan, or Grad PLUS Loan eligibility; or figure out how much to request on the U-M payment plan, use the financial planning calculators in Wolverine Access. Visit the Student Center and select Finances > Financial Planning Calculators.

See our Estimating Costs webpage for more information.

See our Financial Aid Comparison Sheet to estimate your cost of attendance at U-M and to help you compare the financial aid offers you receive from the schools you are interested in attending.

Your Financial Aid Notice lists the average cost of living in U-M housing. Your actual housing and food costs may be higher if you choose to live in a suite or a single room, for example. You must plan for this additional expense.

If you live off campus, you could save money by having roommates. See our Off-campus Student Resource Worksheet.

Learn more about financial aid education pro tips and resources from the Office of Financial Aid.

See our Differences Between Subsidized and Unsubsidized Loans section.

Graduate students and parents of dependent undergraduates must complete the FAFSA and then apply for PLUS loans separately if they need additional funds to cover costs. Applicants may borrow up to the amount of cost of attendance each year, minus any other financial aid received. Parents can use this option to support dependent undergraduate students while graduate students may only apply for the Graduate PLUS loan option.

The Federal Direct PLUS Loan may be of interest to students/parents who are not eligible for other aid, have unusual costs above standard student expense budgets, or need more help after other forms of aid are used.

Plus Loan Eligibility Sample

| + | $30,298 | Cost of Attendance/Budget |

| - | $12,000 | Total Financial Aid Awards |

| = | $18,298 | PLUS Loan Eligibility |

The federal processor will pull your credit report. Because credit reports are valid for a limited time, applications for the fall and/or winter terms will be available in early spring.

If you need additional financing to meet your educational costs, visit our website for information about private loans. Compare rates and terms with the PLUS and Grad PLUS and consider their repayment terms.

Financial aid is paid out at the beginning of the term for which you have enrolled. When and how you receive your aid depends on the type of aid you receive and whether you have completed requirements for receiving your funding.

Your aid will be disbursed based on full-time enrollment. Read the information on this page carefully to find out about how different types of financial aid are disbursed, when you can expect to receive them, and what you must do to receive your funds. To learn about payment of aid, visit our website.

All students returning to campus for continued study must reapply for financial aid by submitting the FAFSA. You can learn more on our website about reapplying for financial aid, including important dates and deadlines, as well as what kind of support you can expect.

If you are about to graduate, leave school, or drop below full-time enrollment, there are several steps you need to take to properly manage the status of your financial aid and plan for the future.

Students should know that any changes in enrollment levels, including the dropping of or withdrawing from courses, could impact financial aid. Be sure you fully understand how dropping a course or withdrawing from the term may impact your financial aid by visiting our website. If you have any questions, be sure to contact our office before you make your final decision to drop a course or withdraw from the term.

When you utilize our offer of financial aid, you agree to review the Award Certification information and fulfill the following responsibilities, including the terms and conditions set by the federal regulations for financial aid.

Don't forget to review Consumer Information.

Satisfactory Academic Progress (SAP) describes a student’s successful completion of coursework toward a degree and is a requirement of receiving financial aid. Visit the Satisfactory Academic Progress webpage for more information.

There is no limit for students who receive failing grades in a course: You may continue to take the course until you pass it (no limit on the number of times a course is repeated when receiving E, F, or W grades). If you receive a grade of D- or higher, you may take the class one additional time and remain eligible for aid for that class. But if you enroll for it a third time, the course will not count for financial aid purposes.

If you are repeating a course, take care that your school or college has not designated it as not-for-credit. If so, it is not eligible for aid and you may be required to repay some of your already-disbursed aid.

Example 1

Sally U. Mich takes a language course and passes it with a D grade. She receives her financial aid.

She wants to better her grade to help with her major requirements so enrolls again and receives a B. She receives aid again for the class.

She enrolls a third time, but will not get financial aid.

A student can repeat the course only once after receiving a passing grade.

Example 2

Samuel Student takes a math course, receives an E and gets financial aid.

He takes it a second time and receives an E; aid is allowed.

He takes it again and receives a C; aid is allowed.

He wants to better his grade so enrolls again. He receives aid.

A student with a failing grade can repeat the course without limit and receive aid. However, they can repeat the course only once after receiving a passing grade.

Learn more about aid eligibility, including enrollment requirements tied to financial aid eligibility, attendance requirements for retaining aid awarded, and more.

Find more information on major financial aid programs available.

Learn more about loans, including information about both federal and private lending options.

Learn more about scholarships, including the steps you need to take to be automatically considered for scholarships

at U-M and how you can apply for additional scholarship opportunities based on special criteria.

To earn Federal Work-Study, a student will need to apply for a Work-Study position and be hired. Federal Work-Study is not applied to university bills – instead, students with Federal Work-Study positions are issued paychecks as they work, and can track their Work-Study earnings in their Wolverine Access account. Work-Study and non-Work-Study job postings, as well as other employment resources, can be found online.

Learn more about the expenses already included in your Cost of Attendance, including the cost of living expenses; books, course materials, supplies & equipment; transportation; miscellaneous personal expenses; and tuition and fees.

The U-M Go Blue Guarantee makes an education at the University of Michigan more affordable for Michigan residents.

If you qualify, your financial aid will include scholarships and grants totaling at least the cost of tuition and mandatory university fees assessed each semester.

Your financial aid may contain a variety of funding (Federal Pell Grant, Federal Supplemental Educational Opportunity Grant, State of Michigan Achievement Scholarship, institutional scholarships and grants, and non-UM tuition scholarships and grants). These, together, make up the Go Blue Guarantee.

Explore the Office of Financial Aid KnowledgeBase for answers to frequently asked questions. Some of the topics covered include:

What will happen to my financial aid if I move to off-campus housing?

Moving off-campus from a dorm does not affect your financial aid. However, housing costs will no longer be automatically charged to your student account; you pay rent directly to your landlord. See the Off-campus Resource Worksheet.

If I have a parent who is enrolled at a college or university, can they be counted as a family member in college when my financial aid is calculated?

No. When we calculate need, credit is given for each sibling living in the household and enrolled at least half-time in an undergraduate college degree program. Parents and high school siblings dually enrolled in college are not included in this number. Multiple children attending college at the same time have a financial impact on a family, and so aid calculations will reduce the amount a family will pay toward college. Reducing the number of family members in college can reduce aid eligibility.

Am I allowed to receive financial aid from more than one institution at the same time?

No. You may receive aid from only one institution.